Supporting your path to financial close.

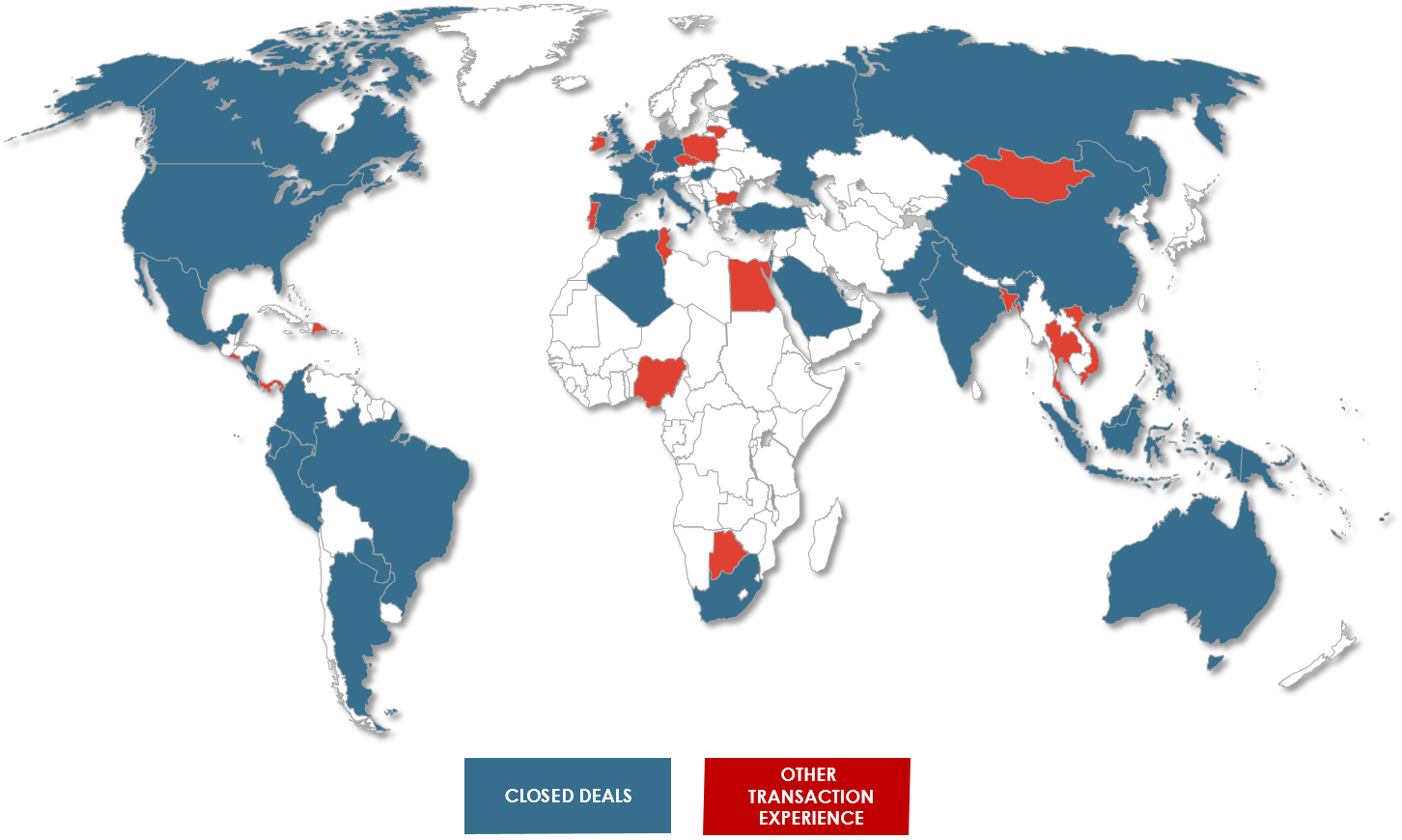

JLS Capital Strategies LLC is an independent advisory firm specializing in raising capital for infrastructure projects worldwide. JLS Capital structures complex transactions to meet credit criteria of equity and debt providers and supports its clients through all steps of the capital origination process. JLS Capital advises on transactions in need of restructuring to work out new sustainable arrangements and restore value on prior investments. JLS Capital supports merger and acquisition activity through asset evaluations and strategic financial services. Our experience covers more than 161 transactions, 70 countries, and $53 billion in finance.

-

Congrats to @SpaceX President and COO @GwynneShotwell on being named @Via_Satellite's 2017 Satellite Executive of t… https://t.co/3I0fxbGmhG

-

Check out our most recent newsletter on energy developments in Latin America in honor of TXF Americas 2018!… https://t.co/KvItmERaZx

More than 166 Transactions Over the World

More than $53 Billion in Transaction Value

Areas of Speciality

project & Structured finance

We advise clients in all phases of the infrastructure capital-raising process. Drawing on the team’s extensive and successful track record of closing transactions around the world, JLS Capital understands key financing obstacles and finds cost effective structures and solutions needed to raise debt and equity. We provide a full-range of advisory services to help deals achieve closure and funding, including advice and assistance on transaction structure, project preparation, financial analysis, term negotiation, due diligence, and deal documentation.

Debt & Asset restructuring

JLS Capital advises clients on innovative debt and asset restructuring strategies that help clients manage existing loans and investments. Working closely with our clients and their lenders and investors, we understand both the sources of financial problems and asset value for every project. Using expert analytical techniques and relying on decades of restructuring experience, our team helps its clients understand creditors’ interests and processes and the keys to getting to successful outcomes. We achieve optimal debt and equity resolutions expeditiously and under the most difficult of circumstances.

M&A and strategic financial solutions

We support clients in their strategic decisions on mergers, asset acquisition, and other capital transactions. JLS Capital offers a full range of asset and business valuation techniques and services, supplementing these techniques with market perspectives, derived from over 40 years of global transactional experience in infrastructure finance. Our in-depth knowledge of infrastructure sectors and global financial markets provide insights that help clients develop sound strategies to capitalize on opportunities for mergers, acquisitions, divestitures, and other investments.