U.S. Finance Agencies Under Biden - One Year Later

President Biden delivered his first State of the Union (“SOTU”) address last night after a truly eventful year, initiated in the wake of an insurrection and marked by truly great and truly awful poll numbers. Before January 5, the conventional wisdom was that President Biden would have to forgo an aggressive legislative agenda and would need to use other levers of the Presidency to get things done. So, on December 1, 2020 and December 22, 2020, JLS Capital published papers on LinkedIn to highlight how the President could advance the “Build Back Better Agenda” (“BBBA”) without legislation through seven U.S. government finance agencies that extend finance for business and infrastructure. These agencies — referred to as “Finance Agencies” and listed below — can provide enhanced strategic support for the infrastructure, small businesses, exports, clean energy and development goals that are important elements of the BBBA.

But by this time last year, the importance of non-legislative remedies such a greater use of Finance Agencies seemed to lessen. With the unexpected results in the Georgia Senate races that gave Democrats control of the Senate, President Biden acted quickly on the legislative front. On March 11, the President signed into law the American Rescue Plan and just days earlier on March 7, Sen. Joe Manchin (D-WV) had opened the door to filibuster reform. Soon after, the White House had published fact sheets for an American Jobs Plan that would become the recently signed infrastructure law and the proposed Build Back Better Act (“BBBA”). Why should a President with approval ratings close to 60% waste time with the conservative approach of utilizing existing agencies better when the possibility of grand legislative action beckoned?

But most of the rest of 2021 didn’t proceed as planned. Even before the Delta and Omicron surges and the exit from Afghanistan that would cause the President’s approval rating to fall, in early April, Sen. Manchin backed off of willingness to vote for filibuster reform. Democrats spent much of 2021 fighting amongst themselves, took most 2021 to enact infrastructure legislation and got stalled on the BBBA, losing statewide elections in Virginia along the way.

Perhaps vindicated by his formation of a coalition that included even historically neutral Switzerland, the President re-asserted many of his legislative priorities last night. And, taking note of the 80 bipartisan bills the President signed year last year, many might succeed. But “Sen. Manchin was quick to pour water over the president’s effort to try to use the moment to try to revive his stalled climate and social spending plan.” An aggressive legislative agenda this year sounds unlikely. Furthermore, the ensuing international chaos will tighten global capital markets and will only increase the importance of Finance Agency capital. So, it is time to review how the President has, can and should make better use of the Finance Agencies to implement the BBBA.

The review presented below shows that so far, there has been little strategic coordination among Finance Agencies. Furthermore, with the stark exception of the SBA where activity mushroomed in Trump’s last year and has continued at impressive levels, there has been fairly modest Finance Agency activity relevant to the BBBA.

Bipartisan Job Growth

The Finance Agencies’ missions have long been considered matters of national consensus. Their programs have enjoyed bipartisan support for decades with the one notable exception of opposition from groups aligned with the Heritage Foundation and the Koch Network.

Moreover, in the U.S. market economy, Finance Agencies may be the Federal Government’s most effective levers for creating the millions of high paying jobs that are a priority of the BBBA. As noted last year, Finance Agencies are more effective job-creation tools than policies favored under the previous administration. Notwithstanding its name, the Tax Cuts and Jobs Act of 2017 created very few jobs, according to the Congressional Research Service. Tax cut funds were “used for a record-breaking amount of stock buybacks” Even conservative economists concede “regulations have little effect on overall employment, but just move jobs from one place to another.

In contrast, Finance Agencies help create jobs by supporting investment by small businesses, exporters, green energy companies, and infrastructure developers that are the economic engines of a market economy. The example cited last year is the relationship between EXIM support and manufacturing jobs. As shown, when EXIM increased support in the wake of the 2008 financial crisis, manufacturing job loss turned into large gains. As EXIM support waned with the bank’s deauthorization and loss of Board quorum, manufacturing employment fell, turning into a net manufacturing job loss by 2016.

Need for Coordination

As pointed out last year, planning strategies for Finance Agencies is complicated by the fact that the seven agencies are scattered among myriad agencies that fall under separate areas of consideration in a traditional transition plan. Under the Biden’s Transition Agency Review plan, there were seven different Agency Review Teams for the seven Finance Agencies. While some specialization among agencies with different missions would be expected, there is substantial overlap among skills required for success at Finance Agencies, (e.g., credit, banking, negotiation, and deal-making). To be effective, political leaders of Finance Agencies require background and expertise in these areas.

But a year later, there is no evidence of coordination. Furthermore, due in part to a difficult Senate approval process, the Biden Administration has been slow to place confirmed political leadership at agencies. Only two of the seven agencies (the SBA and DEO/LPO) got new leadership during 2021. Scott Nathan was just confirmed as DFC CEO on February 9, 2022 and Reta Jo Lewis was sworn in as EXIM’s first black female Chair on February 16. WIFIA has not recently had a political head and at Rural Utility Services and the Build America Bureau, leadership hasn’t changed. While stability and senior, experienced non-political staff may offer advantages, a lack of political leadership is not conducive to a coordinated strategy. The Administration must make placing leadership in Finance Agencies a priority. Avoiding delays in the future will depend on reforming Senate rules that allow one Senator to place holds on nominees that only be overcome through a cumbersome process.

SBA Dominating Activity

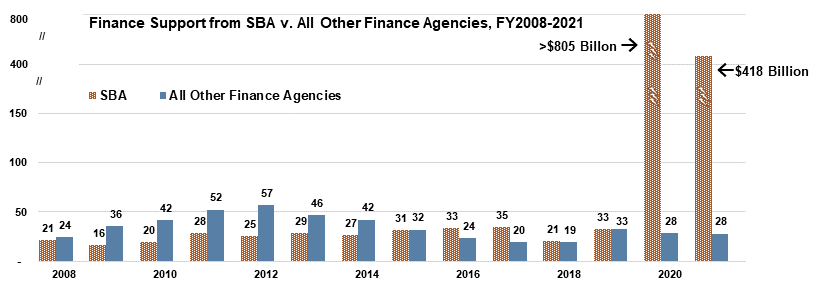

Data presented last year on Finance Agency commitments and authorizations through FY 2019, showed that the SBA was beginning to dominate total activity, authorizing support greater than the other six agencies combined. A year later, SBA support has mushroomed and the gulf between SBA and all the other agencies has become positively massive. As shown below in Fiscal Year 2020 SBA support exploded from $37 billion in 2019 to over $750 billion in 2020. Authorizations for Biden’s first year in FY2021 should be about 2/3 of 2020 - down but at $418 billion, still a huge departure from all other years. Not surprisingly, over 2/3 of this support in each year went to the badly needed paycheck protection program.

What is surprising is that nearly 25% of SBA’s support in 2020 and 2021 went for disaster relief. That’s nearly $300 billion in two years. While the new avenue of SBA support for disaster relief may be a welcome one, it tends to hide the spike in disaster relief being that has needed because of climate change, whereas disaster relief spending should be a way to shine a light on the importance of climate change programs at the US DOE/LPO and elsewhere.

Part I of the 2020 article identified five broad priorities for Finance Agency action to address problems that had arisen under the prior Administration and Part II summarized Finance Agency performance with respect to these priorities. A year later, how are we doing? The report card is mixed.

The SBA faced challenges to address the misdirection for PPP to large businesses in 2020. So far, the SBA deserves high marks. As President Biden said in his SOTU address, “the watchdog is back”. The evidence that the SBA has addressed this issue is in part the lack of new stories on misdirection of funds. More importantly, in its FY2021 annual report and in testimony before Congress, SBA documents substantial progress with respect to problems in the PPP and also in addressing problems in the disaster relief programs.

There has been substantial progress on infrastructure with the signing of the Infrastructure Act. That said, fairly little of this success has involved the finance agencies with no new projects reported by TIFIA and the Build America Agencies. WIFIA did announce new loans including a $477 million project in Hampton Roads and WIFIA loans are now financing a total of $24 billion in water infrastructure. But overall Finance Agency support is down. Given that Finance Agencies may be the most efficient delivery mechanism for infrastructure development, they should be doing more.

DOE/LPO Director Shah, has taken steps to reinvigorate the loan program and there are positive indications that DOE LPO will be more customer oriented. But DOE LPO has not yet reported new activity and the agency still has available loan authority of $40 billion for advanced vehicle manufacturing, nuclear energy, renewable energy, and other technologies that can help address the threat of climate change, a threat that becomes more important every day.

The RUS budget for rural power and telecommunications infrastructure has remained stable, but, with no annual report or other documents similar to other Finance Agencies, data on the utilization of this authority remains difficult to assess and actual activity appears low. There is certainly no evidence that the RUS is assuming more authority than the FCC in rural areas, where RUS funding may closer to and better positioned to address problems.

The verdict with respect to the Trump Administration’s failed trade deal with China is in and confirms JLS Capital’s assessment from last year. The Chinese took (Trump) to the cleaners, according to a Paul Krugman’s (New York Times) assessment of Peterson Institute data. The Chinese purchased none of the goods they promised to buy. The Biden Administration has had little to gain by highlighting a failure it had no intention of replicating or continuing. The bigger priority is to address the concrete challenges of competing with a Chinese government that supports many times more exports than does the U.S. DFC activity last year was up to $6.8 billion but with EXIM authorizations only about $5.8 billion, the combined finance of the two agencies is only about 10% of China’s support that includes $55 billion of non-transparent unconfirmed finance.

EXIM’s continued low level of support is particularly troublesome as EXIM’s activity is not much greater than it was when EXIM’s authorization had lapsed or been curtailed. In the 2009-2015 period, EXIM’s activity doubled from historical levels before plummeting in 2016. As shown below, even with a large deal that increased EXIM’s 2019 authorizations to $8 billion, EXIM’s annual average from 2019 is only about $7 million per year, only about $2 billion per year more than when EXIM could not authorize deals over $10 million. This stagnation has critical implications for the U.S. economy. Perhaps not coincidentally, while there was some job growth in 2019, manufacturing jobs fell sharply with the pandemic and have not recovered. According to the Bureau of Labor Statistics, there has been no new net manufacturing job creation since early 2018.

Moving Forward

While there have been successes in Biden’s first year, the balance of the record suggests the Finance Agencies can do more and agencies such as EXIM Bank can do a lot more. New leadership installed at EXIM and at DFC will be a help. Perhaps with the Infrastructure Act passed, Build America and TIFIA can do more. With motivated leadership, perhaps DOE/LPO can do more to address dire threat of climate change that its program was designed to address, the time is now to start picking up the pace.

In the weeks ahead, JLS Capital Strategies will explore additional aspects of the Finance Agencies in depth to explore such issues as:

Why is EXIM’s activity so low? Is this the new normal or has the rest of the world passed the U.S. by?

How many federal resources are going into disaster relief? Is the cost of living climate change already much greater than we all think?

Is US DOE LPO really coming back and if so, when? What are the opportunities and obstacles?